Lp 4 answer key | Economics homework help

Chapter 13

2. Lowe Technology Corp. is evaluating the introduction of a new product. The possible levels of unit sales and the probabilities of their occurrence are given.

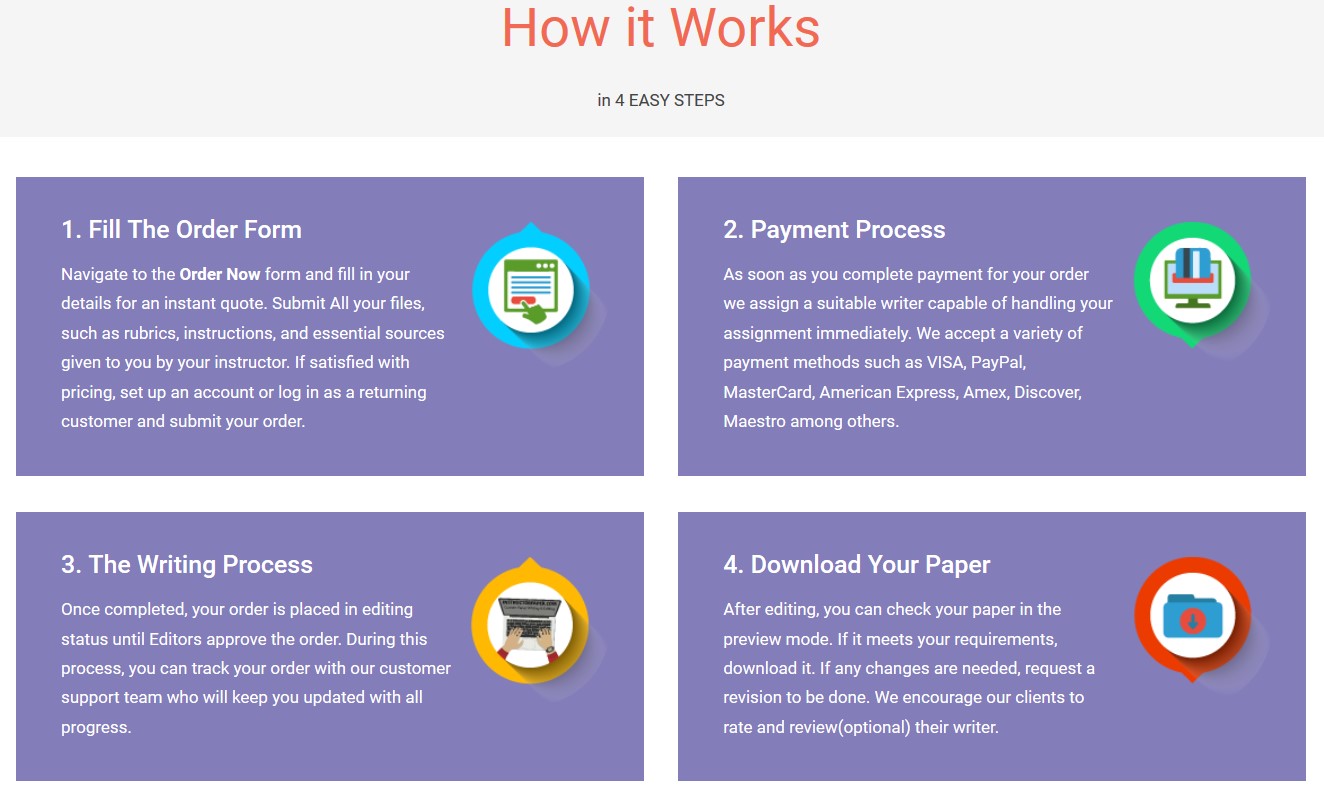

Save your time - order a paper!

Get your paper written from scratch within the tight deadline. Our service is a reliable solution to all your troubles. Place an order on any task and we will take care of it. You won’t have to worry about the quality and deadlines

Order Paper NowPossible Market Reaction Sales in Units Probabilities

a.) What is the expected value of unit sales for the new product?

D (x) P (=) DP

b.) What is the standard deviation of unit sales?

3. Northern Wind Power, a new age energy company, is considering the introduction of a product intended to use wind as an energy-producing device. The possible level of unit sales and the probability of their occurrence are given.

Acceptance Potential Sales in Units Probabilities

a.) What is the expected value of unit sales for the new product?

b.) What is the standard deviation of unit sales?

4. Shack Homebuilders, Limited, is evaluating a new promotional campaign that could increase home sales. Possible outcome and probabilities of the outcomes are shown below. Compute the coefficient of variation.

Possible Outcomes Additional Sales in Units Probabilities

7. Five investment alternatives have the following returns and standard deviations of returns.

Alternatives Returns: Expected Value Standard Deviation

A……………………………………. $ 1,200 $ 300

B………………………………… 800 600

C………………………………… 5,000 450

D………………………………… 1,000 430

E………………………………… 60,000 13,200

Using the coefficient of variation, rank the five alternatives from lowest risk to highest risk.

10. Sensor Technology wishes to determine its coefficient of variation as a company over time. The firm projects the following data (in millions of dollars):

Year Profits: Expected Value Standard Deviation

a.) Compute the coefficient of variation (V) for each time period.

b.) Does the risk (V) appear to be increasing over a period of time? If so, why might this be the case?

11. Tim Trepid is highly risk-averse while Mike Macho actually enjoys taking a risk.

a.) Which one of the following four investments should Tim choose? Compute coefficients of variation to help you in your choice.

b.) Which one of the four investments should Mike choose?

The coefficient of variation for the project is 0.726.

Based on the following table of risk-adjusted discount rates, should the project be undertaken? Select the appropriate discount rate and then compute the net present value.

Coefficient of Variation Discount Rate

Appendix B

Years Cash Inflows PVIF @ 12% PV

21. Allison’s Dresswear Manufacturers is preparing a strategy for the fall season. One alternative is to expand its traditional ensemble of wool sweaters. A second option would be to enter the cashmere sweater market with a new line of high-quality designer label products. The marketing department has determined that the wool and cashmere sweater lines offer the following provability of outcomes and related cash flows.

Expand Wool Sweaters Line Enter Cashmere Sweaters Line

Present Value of Present Value of Expected Sales Probability Cash Flows from Sales Probability Cash Flows for Sales

The initial cost to expand the wool sweater line is $110,000. To enter the cashmere sweater line either initial cost in designs, inventory, and equipment is $125,000.

a.) Diagram a complete decision tree of possible outcomes similar to Figure 13-8 on page 421. Note that you are dealing with thousands dollars rather than millions. Take the analysis all the way through the process of computing expected NPV (last column for each investment).

(1) (2) (3) (4) (5) (6)

Present Value

of Cash Flow NPV Expected NPV

Expected From Sales Initial Cost (3)-(4) (2) x (5)

Sales Probability ($ thousands) ($ thousands) ($ thousands) ($ thousands)

Expected NPV = $ 21,000

0)

Expected NPV = $ 41,000

b.) Given the analysis in part a, would you automatically make the investment indicated?

24. Treynor Pie Co. is a food company specializing in high-calorie snack foods. It is seeking to diversify its food business and lower its risks. It is examining three companies-a gourmet restaurant chain, a baby food company, and a nutritional products firm. Each of these companies can be bought at the same multiple of earnings. The following represents information about the companies.

Correlation with Sales Expected Earnings Standard Deviation

Treynor Pie ($ millions) ($ millions) in Earnings

Company Company ($ millions)

a.) Using the last two columns, compute the coefficient of variation for each of the four companies. Which company is the least risky? Which company is the most risky?

b.) Discuss which of the acquisition candidates is most likely to reduce Treynor Pie Company’s risk? Explain why.

"If this is not the paper you were searching for, you can order your 100% plagiarism free, professional written paper now!"